Please update your browser.

Easily manage your payment processing with online tools to help you monitor and manage your payments activity – simply use online banking or the Chase Mobile® app.

Easy

Get the Chase Mobile app by

texting “mobile” to 24273 for a

link or find it in the app store.

Convenient

You decide when it’s time to

manage your payments and

Chase business accounts from

one central location.

Secure

We’re working to help safeguard

your sensitive payments information

with encryption technology.

Chase Online Account

Manage your payments from anywhere, anytime using your CBO online account.

Quick Links

Process Refunds Online

It happens. You need to refund a sale, but your card reader isn’t readily available, or you don’t have the customer’s card. That’s ok. You can process a refund from anywhere using your PC, laptop or mobile device. Simply sign in to Chase.com to get started. For step-by-step instructions, watch our how-to video, or click Learn More.

Managing Tips Online

It’s important to adjust your sales to include tips before your daily settlement, but sometimes that may not be possible. Or you may also prefer doing it from the convenience of your PC, laptop or mobile device versus the card reader. We’ve made managing tips more flexible with Chase.com. Simply sign in when convenient for you and adjust your tips right from your computer or mobile device.

Watch our quick how-to video or click Learn More.

Resources to help you manage your payment processing

FAQ: Establishing & Managing Accounts

How do I establish a retail or online merchant account?

Our trained experts will listen to your needs and recommend solutions to help you surpass your business objectives.

What are the costs for your processing and other services?

Because each of our customers has unique needs, our processing services are customized according to the specifics of their business. Pricing is based on factors such as type of industry, method in which payments are accepted, card types accepted and a number of other variables. To receive a personalized pricing quote from one of our helpful representatives, call us at 800.708.3740.

How long does it take to set up a merchant account?

The time it takes to establish a merchant account depends on several factors including: completeness of the application submitted, accuracy of the information provided and any required additional paperwork. After your application has been approved, it usually takes just a few days to establish the actual account and to arrange for any required training. (Canadian and international processing set-ups are completed in 10 days to two weeks.)

Why does Chase need to review my credit information?

As an acquirer, Chase takes on risk with every merchant transaction. When a transaction takes place, the cardholder is debited and the merchant is credited for the amount of the transaction. The cardholder still has chargeback rights and can dispute the transaction for up to 90 days. When a cardholder initiates a chargeback with a valid reason code, the funds are automatically taken from the merchant's account and credited back to the cardholder. Chase wants to ensure that each potential merchant is financially sound, has a viable business and is operating in good faith and standing, so these disputes can be resolved with the merchant.

What will my statement look like?

To view an interactive sample statement and understand how to read it, please visit our interactive How to Read Your Statement tool.

Is there a contract?

Yes. We have several different contracts depending on the merchant's size and individual processing needs.

I want to start conducting transactions over the Internet. Do I need to set up a new account or can I just use my existing account?

If you're already a Chase merchant, a separate merchant outlet number will be provided for your online store. Please contact your Account Executive to handle this addition to your account. We can provide you with chain reporting so you can have both a separate and consolidated view of your company's credit card processing activity. If you need to build an e-commerce website, Instant Storefront™ can help you get up and running quickly.

Can a merchant outside the U.S. apply for a merchant account with Chase?

Yes, merchants with legal presence in the US, Canada or Europe (ecommerce only) can be accepted for merchant services.

Can Chase handle currency exchange?

Yes, we provide international currency processing. We give merchants the flexibility to price a product in a consumer's local currency, remit a transaction denominated in that currency and receive local currency into a bank account - anywhere in the world. Our "single file" processing capability allows multiple currencies to be settled in a single batch file, or you can send multiple batch files by currency type. Go to Products and Services for more information.

Will my merchant account be approved with a processing limit?

Merchant accounts are approved based on actual or projected dollar volume. Chase monitors account activity and reserves the right to review accounts at any time should volume be significantly above or below the level represented on the merchant application.

Am I liable for disputed transactions?

MasterCard® and Visa® Card Association rules and regulations govern liability with respect to disputed transactions. In general, you, the merchant, are not liable for disputed retail transactions if a card was swiped through a terminal, the cardholder's signature was obtained and an authorization was obtained. When the card is not present at the time of the transaction, the merchant assumes liability for any disputed charges. Such disputes may be reversed depending on the timing and nature of the cardholder claim. Chase provides products and services to help our merchants manage this process efficiently.

How do I receive payment for the transactions I submit to Chase?

Using Automated Clearing House (ACH), Chase will remit funds due for your MasterCard, Visa, Diners Card®/Carte Blanche® and JCB transactions to your business bank account. When/if you establish a service agreement with American Express® and/or Discover®, these issuers will obtain your banking information and pay funds directly to your bank account.

How can I view my account information?

Chase offers several online and offline tools to access information about your merchant account. With these tools you can view, download and import account information such as transaction activity, deposits, funding, chargebacks, retrievals and statement information. Learn more about Chase's online reporting tools.

When should I inform my current payment processor that I will be closing my account?

You should wait until your account is set up to process your transactions through Chase. Once you're ready to process with us, you can inform your previous provider.

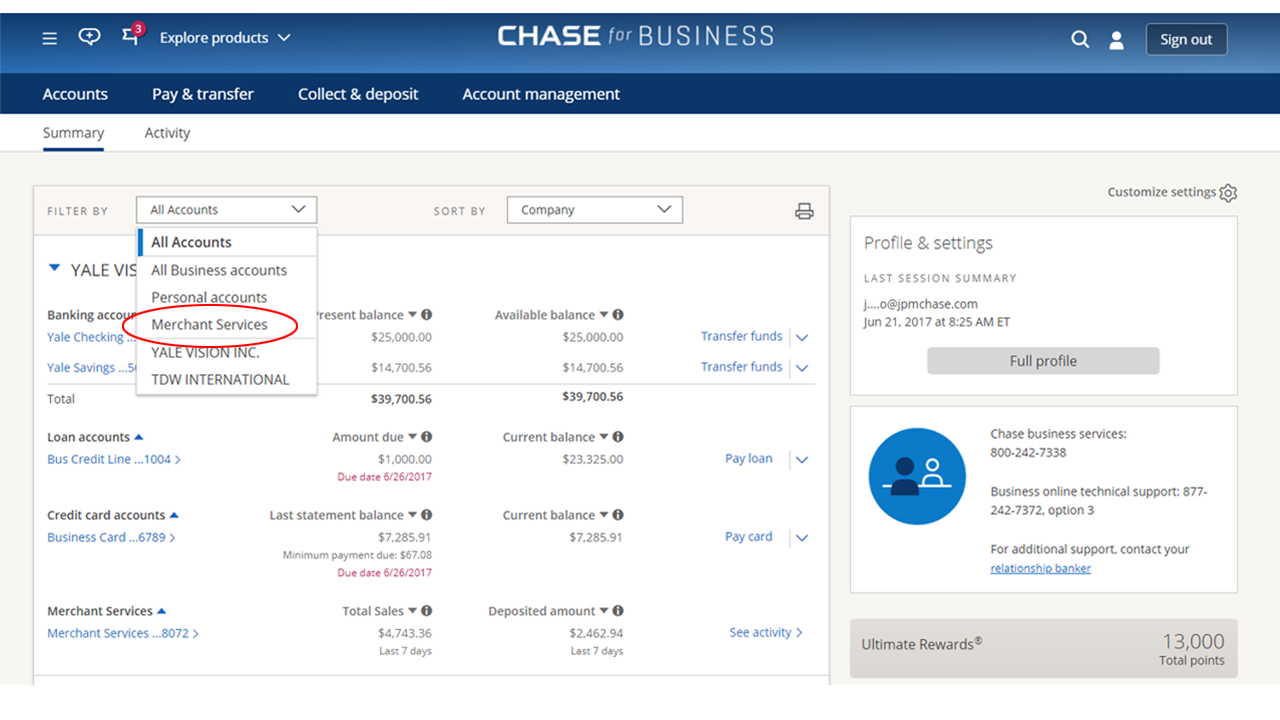

You can view your Merchant Services account by signing in to your online account at Chase.com/business, selecting Merchant Services from the list of accounts on the left.

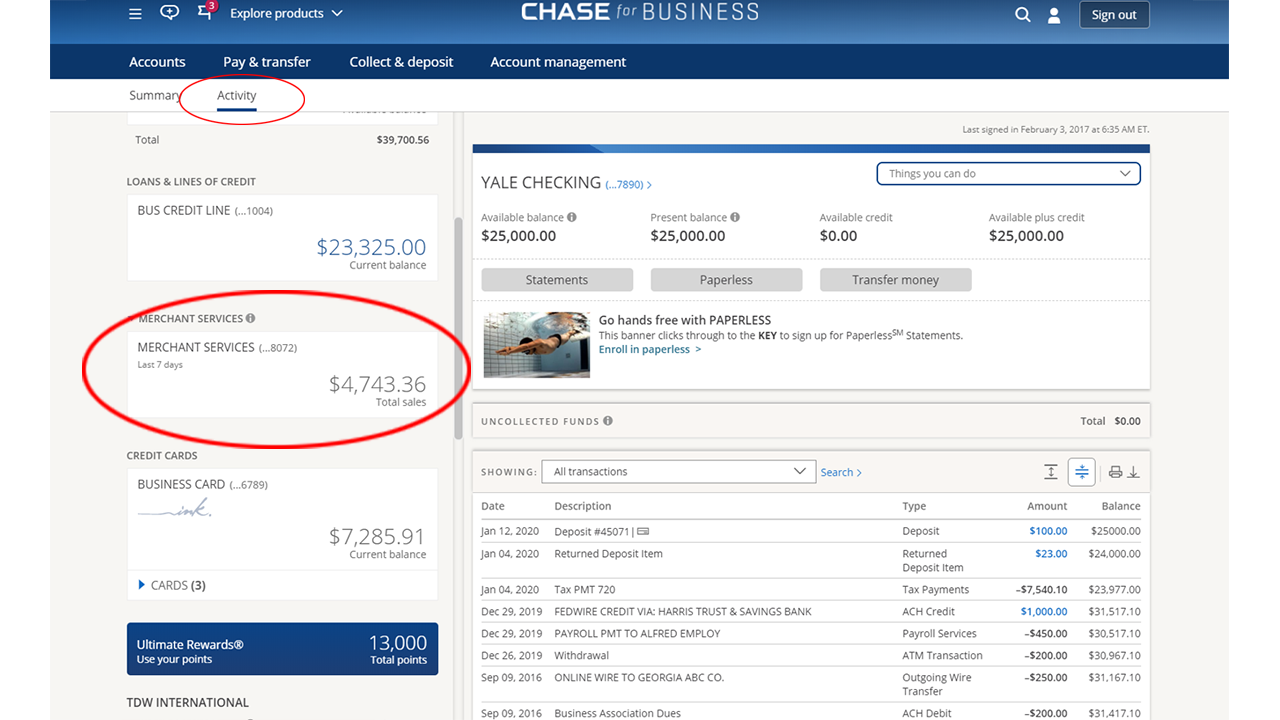

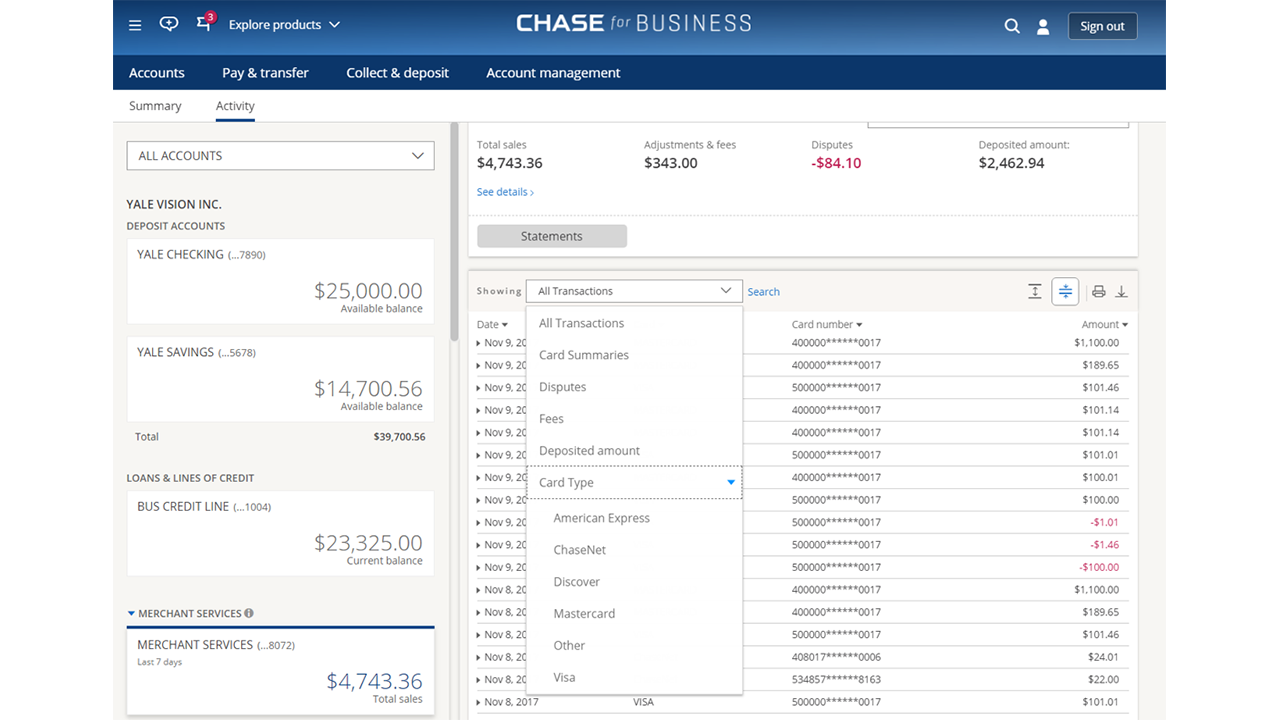

You can view your transaction activity, deposits and chargebacks and disputes; you can also print or download your account information.

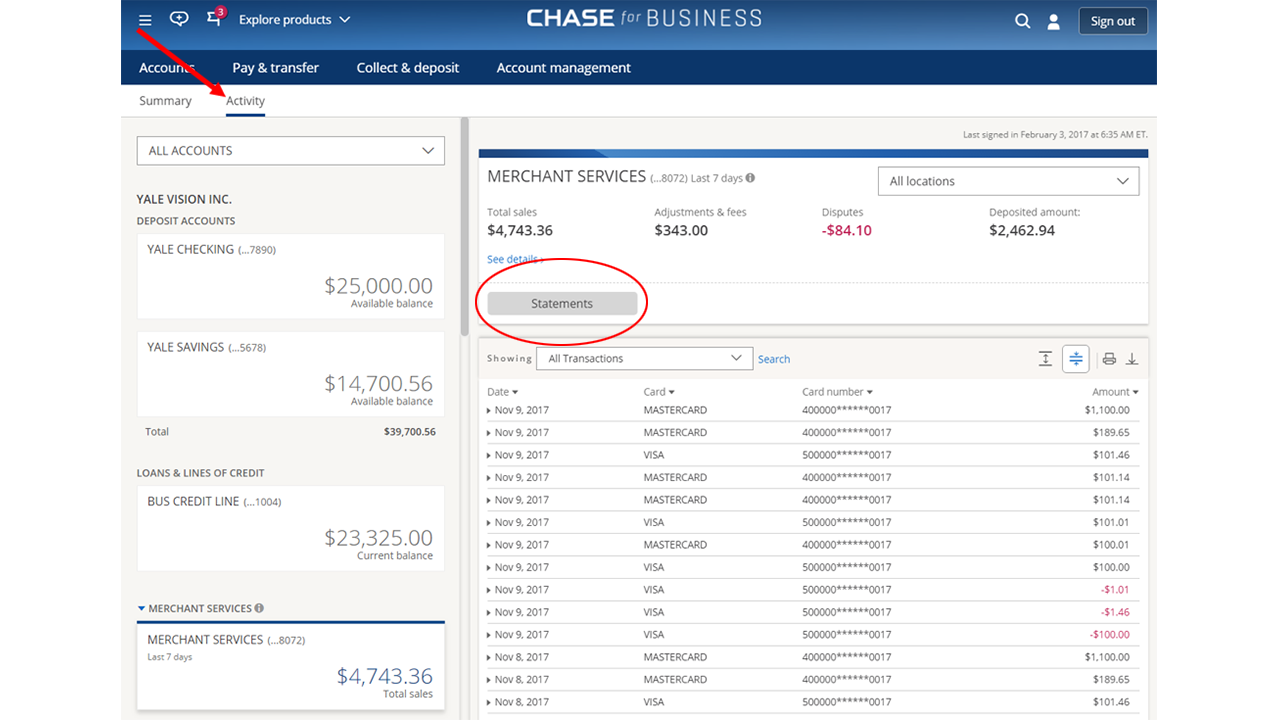

You can find your statement from the main menu (≡ icon), select Statements & Documents, then select your Merchant Services account from the left pane. Or, you can click the Statements button on your Merchant Services account Activity page.

You can find your transactions under the Merchant Services Account section.

If you’ve already set up your online account access, simply sign in with your existing user name and password. If not, simply download the Chase Mobile® app from the App Store. View your transactions and manage your account information from the app on your mobile phone or tablet.

If you have questions about Chase.com, visit Chase.com/business/online-banking.

Find more on how to prevent and manage chargebacks and disputes in the Disputes (Chargebacks) Explained section.

Alerts

Know when your settled payments are deposited, when your statement is available or when you have a dispute with Account Alerts. See how to turn on your alerts here.

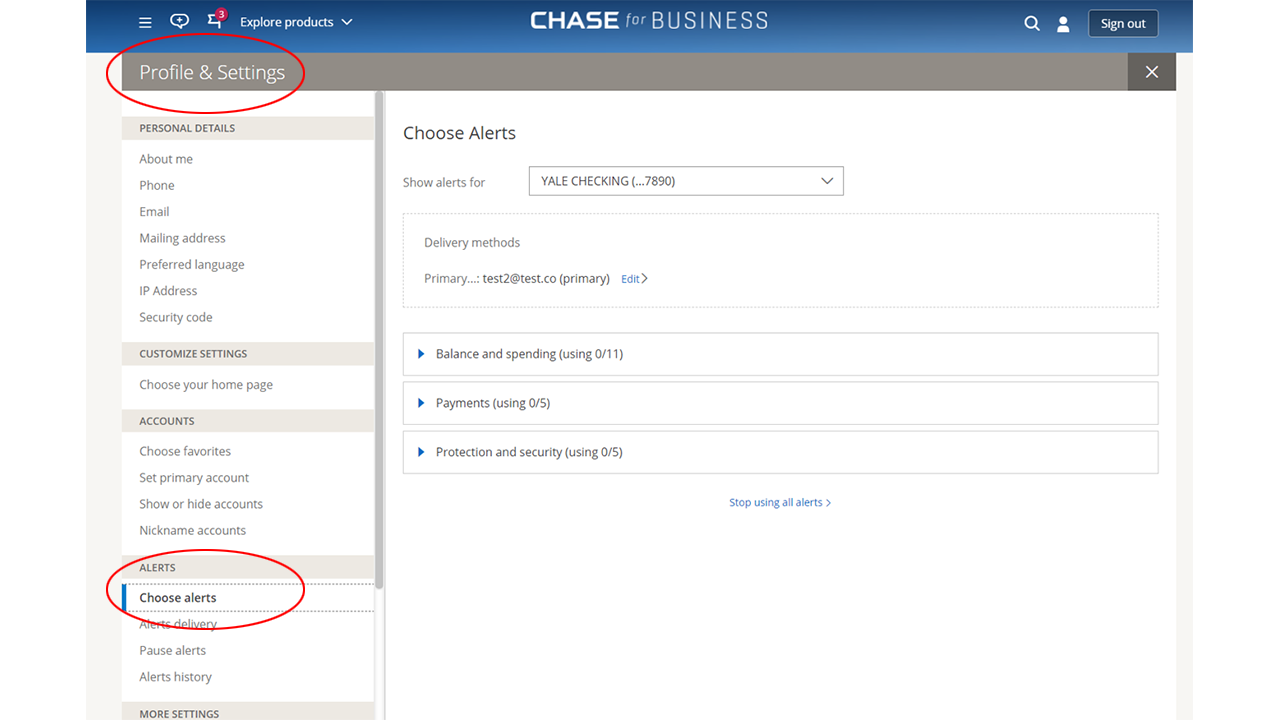

• Update your profile and settings.

Go to “Account management” on the menu bar; click “Profile & settings”.

From the left-side menu, under “Alerts,” select “Choose alerts”.

• Choose your alerts.

Select your merchant account and desired alerts from the drop down lists. You can sign up for as many as you'd like.

Select your preferred format: email, text message, push notification.

• Save your changes.

Receive alerts about your account activity including statements, deposits, and disputed charges.

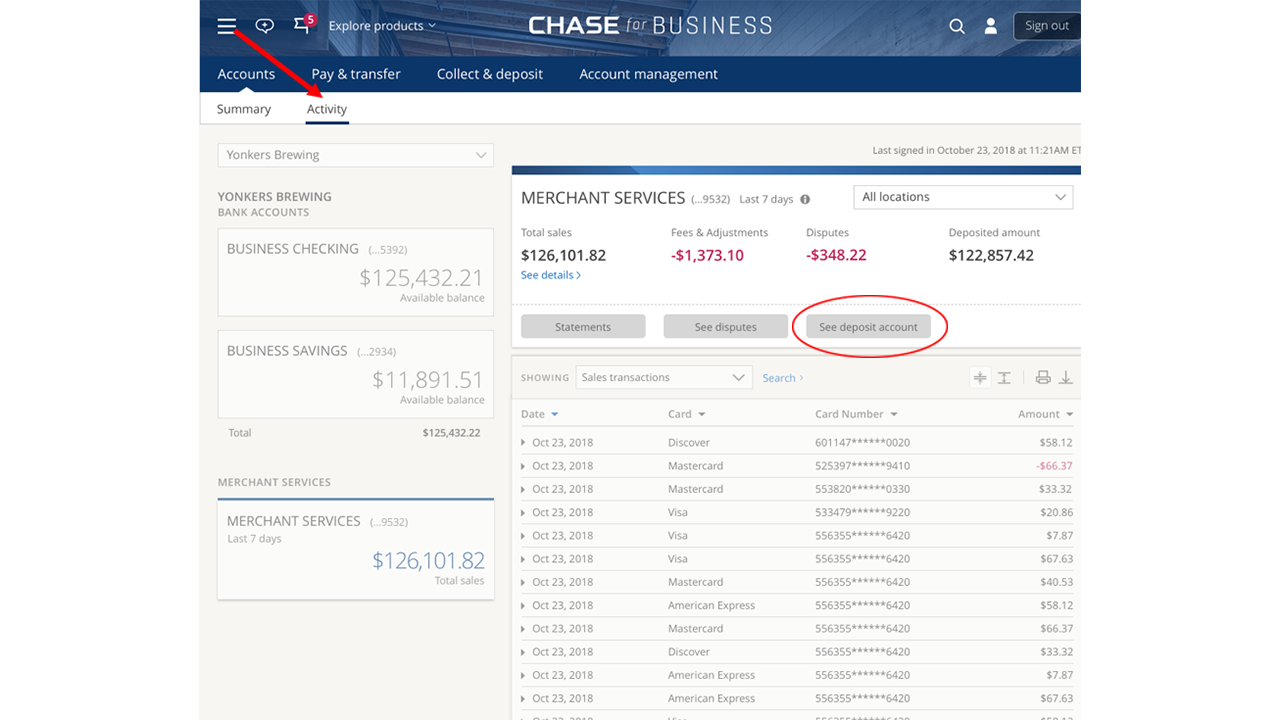

From the Account Activity Page:

1. Select a Merchant Services account from the left panel.

2. Select “Deposit Account.” Your current deposit account will be visible. Confirm this is correct or click “Update deposit account” to make your changes. Please note if you have more than one deposit account, you will see a message to contact us to help update your account.

3. Complete the multifactor authentication process.

4. Select a new account. Both your Chase accounts and externally linked accounts will be available for selection in the dropdown list.

5. Confirm the update.

To add a new external account:

Click “Add new external account” and follow the instructions to add the new account to the dropdown list. Select the new account from the list and proceed with the update. External accounts will require additional validation steps to validate the account.

Interchange is when the card payment transaction is passed between the merchant and Chase Merchant Services, between us and the payment brands (such as Visa® and MasterCard®), and between the payment brands and the bank that issued the card. A fee is charged on every transaction you process. The fee is paid by the payment processor to the issuing bank through the payment brands. It is charged to cover the cost to issuing banks for offering lines of credit and fraud mitigation.

Interchange fees are determined by the payment brands. The rate that you pay for a transaction varies depending on type of card (debit, credit, rewards card), type of transaction (the card is present, a phone order, an online order) and your average transaction volume. The fee charged is also tied to the level of risk for that transaction; the lower the risk, the lower the rate. So for example, a transaction conducted with a card that is present is a lower risk and fee than a card-not-present transaction.

In addition to interchange fees, the individual payment brands may charge a separate assessment fee, covers the operating costs of managing their network. Assessment fees which cover the operating costs of managing their payment network. These are also mandated by the individual payment brands and not your payment processor.

View all of the latest payment network updates.

To learn more about current interchange rates, visit the payment brands' Web sites:

Visa

MasterCard

Discover: Web site not available, please contact Discover at 866.710.3356

We're here to help you protect your payments business and stay resilient with updates, resources and how-to's.

Get up-to-date information on our Payments Continuity Page.

Full Business Resiliency resources can be found on our Business Resiliency Site.

A key element of accepting contactless payments is making sure your staff are trained and ready to assist customers. Follow the simple steps below.

- Let customers know they can tap to pay even before you ring them up. You can do this both with decals at the entrance and checkout, as well as by mentioning this as an option, “would you like to tap to pay today?” If you need decals, simply call Chase Customer Service at 888-886-8869.

- If the customer wants to tap to pay and needs assistance, have them select their card/digital wallet.

- Card: If the customer is not sure if their card allows for contactless payment, have them look to see if their card has a contactless indicator on either side.

- Digital Device: If the customer wants to pay from a mobile phone or wearable, they will need to have a payment app installed and loaded with a card (such as Apple Pay, Google Pay, Samsung Pay). Have them open the app on their device and select their digital card.

- Card: If the customer is not sure if their card allows for contactless payment, have them look to see if their card has a contactless indicator on either side.

- When ready to pay, have the customer hold their card or digital device about 2-3 inches above the symbol on the credit card terminal.

- Once you get confirmation from the terminal, let the customer know the transaction is complete.

- If there is no payment confirmation, have them try again, check the distance and make sure they are holding the card or device flat toward the terminal.