Please update your browser.

How to Read Your Statement

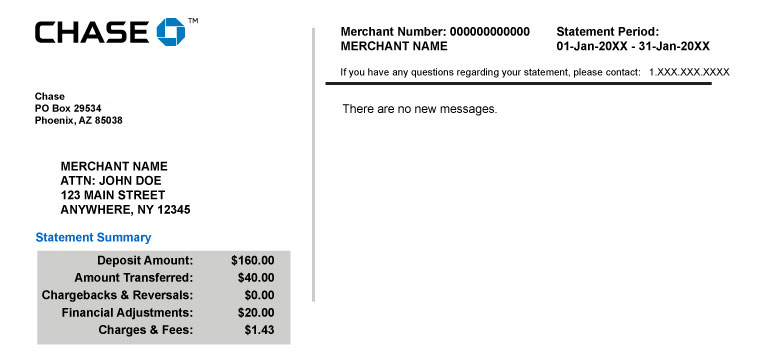

Cover:

The cover page displays your address, general processing information and a customer service number. It also features a special section to notify you of important service and account information as well as a quick summary of what's inside your statement.

Deposit Amount: The total net dollar amount (Sales minus Returns) of all submitted batches of transactions

Amount Transferred: Total dollar amount transferred to your bank account by Chase

Chargebacks & Reversals: Total dollar amount of transactions refuted by customers or flagged by the payment card issuing bank for a technical issue

Financial Adjustments: Total dollar amount charged or credited to your merchant account

Charges & Fees: Total dollar amount for fees charged either by Chase or the Payment Brands

Deposit Summary:

This is an overview of all your transactions processed for the statement period by card type, including any financial adjustments made to your deposits. The negative amounts (credits withheld or removed from your deposits) are indicated in red text.

Total Deposit Amount: The total dollar amount (Sales minus Returns) of all submitted batches of transactions

Deposit Adjustments: Dollar amount of transactions that were rejected and not processed

Net Deposits: Total Deposit Amount minus Deposit Adjustments

Funded: The portion of Net Deposits that are eligible for funding by Chase (as opposed to being eligible for funding by a third party, like American Express); more detail is provided in the Funding Summary section

Totals By Card Type: Total Funded amount, separated by card type; the actual amount is to the right of the card type; see Credit Card Summary section for more details

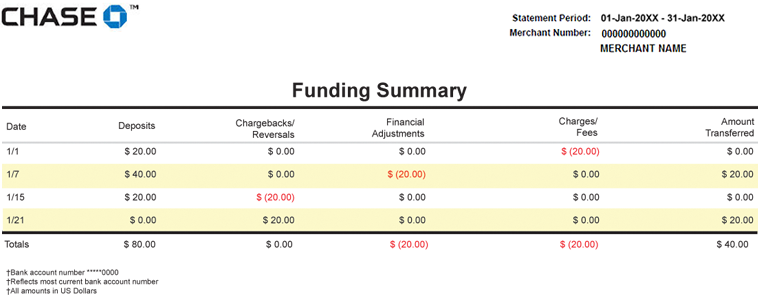

Funding Summary:

This page provides a drill-down of the Funding column in the Deposit Summary section, showing the difference between the Funded amount and the amount actually transferred to your bank by Chase. Negative amounts are indicated in red text. For more details, see the Chargebacks & Reversals, Financial Adjustments and Charges & Fees sections.

Deposits: Same as Funded column from Deposit Summary section; the portion of Net Deposits that are eligible for funding by Chase (as opposed to being eligible for funding by a third party, like American Express)

Amount Transferred: Total dollar amount transferred to your bank account by Chase

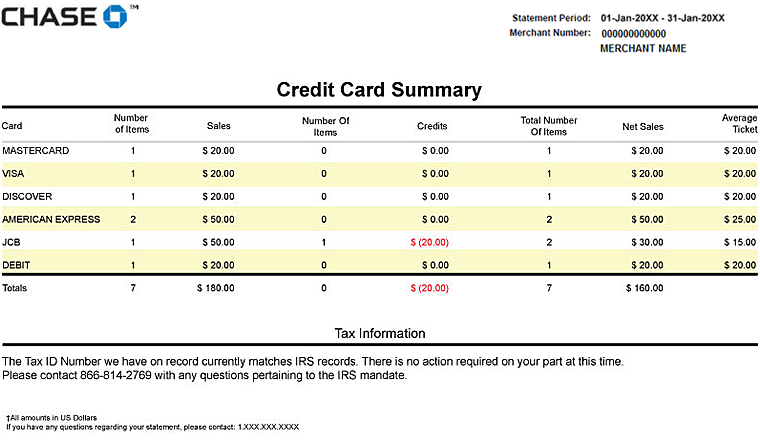

Credit Card Summary:

The Credit Card Summary provides a detailed breakdown of your sales by card type for the statement period.

Number of Items: Total number of sales transactions by card type

Number of Items: Total number of credit transactions (Returns) by card type

Total Number of Items: Total number of transactions (Sales and Returns) processed by card type

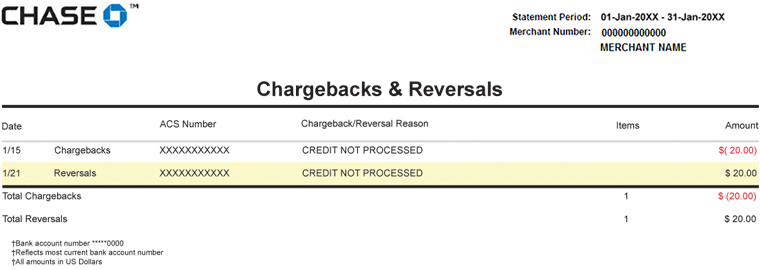

Chargebacks & Reversals:

This section details your Chargebacks/Reversals from the Funding Summary section. Chargebacks/Reversals generally occur when a customer refuses to accept responsibility for a charge to his or her payment card. They may also be initiated by the payment card issuing bank due to a technical issue, such as no authorization approval code received.

ACS Number: This Automated Case Number (ACS) is assigned to the chargeback/reversal and may be used for disputing any chargebacks or reversals

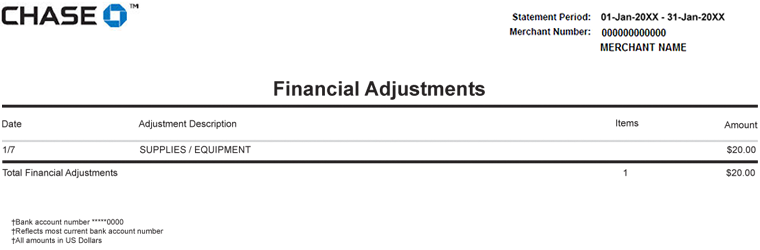

Financial Adjustments:

This section details any Financial Adjustments from the Funding Summary section, itemizing adjustments processed based on date and description. The amount charged to your account is indicated in black, while any credits to your account are indicated in red.

Amount: The dollar amount of the adjustment on the given date

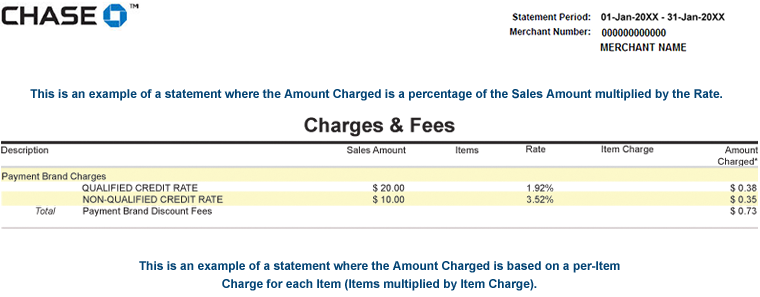

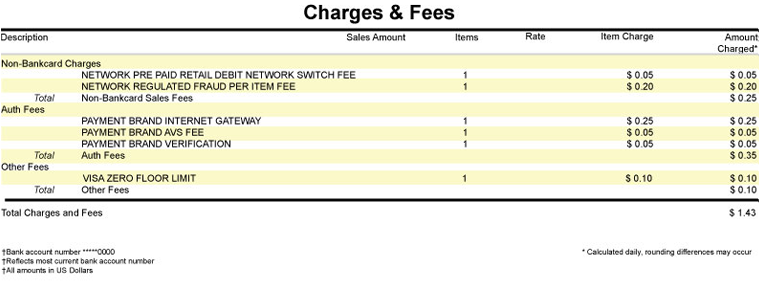

Charges & Fees:

This section details your Charges/Fees from the Funding Summary section. The Amount Charged is dependent on whether the category of charge/fee is a Rate, per-Item Charge, or both.

Sales Amount: The amount of the sale, before fees, refunds or adjustments have been applied (gross sales)

Rate: This percentage rate is based on your specific fee structure

Amount Charged*: This section details your Charges/Fees from the Funding Summary section. The Amount Charged is dependent on whether the category of charge/fee is a Rate, per-Item Charge, or both.

Items: Total number of billable items, which are specific to the fee in question

Item Charge: This is the per-item charge based on your specific fee structure

* The number of items is multiplied by the Item Charge to calculate the Amount Charged